Learn About The World Of Luxury Assets And Collateral Lending

The Timeless Allure of Salvatore Ferragamo’s Accessories Collection

With a history steeped in innovation and artistry, Ferragamo’s accessories continue to captivate audiences and fashion connoisseurs worldwide.

How Much Does it Cost to Own a Luxury Watch?

Owning a luxury watch is more than just having a device that tells time. When you own a luxury watch, you own a piece of art, a status symbol, and a piece of history.

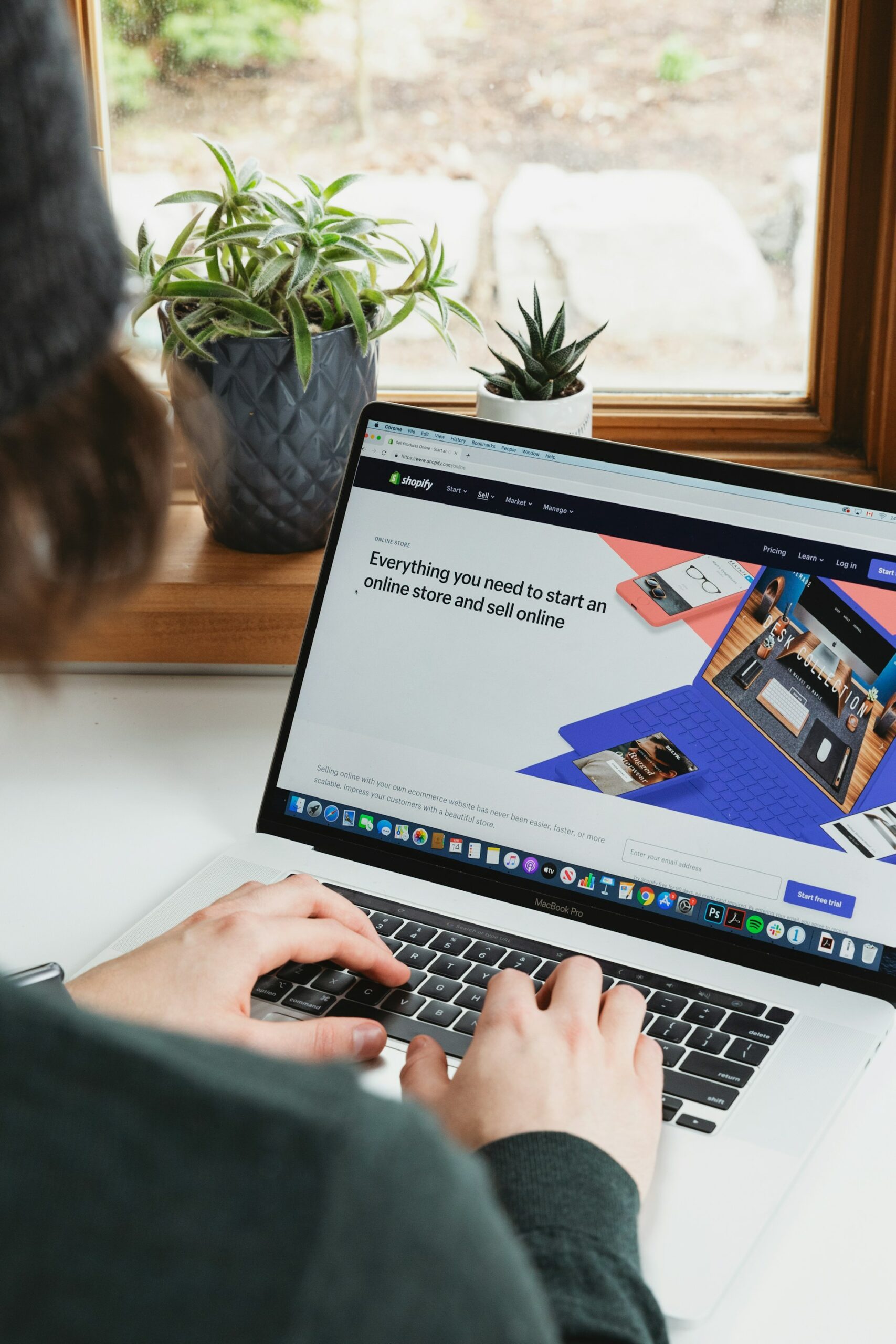

The Impact of E-commerce on Luxury Brands

This article will discuss the impacts, both positive and negative, of e-commerce on the luxury brand market.

Everything you need to know to build a luxury collection

Elevate Your Style with These Iconic High-End Jewelry Brands

From dazzling diamonds to exquisite gemstones, these iconic brands offer a range of timeless pieces that can truly elevate your style.

The Ultimate Guide to the Rolex Submariner

In this comprehensive guide, we will explore the history, features, and different variations of the Rolex Submariner, helping you make an informed decision when choosing the best Submariner watch for your collection.

Why Watches Are Such a Popular Luxury Asset

The question that arises is: what makes these timepieces so desirable and sought-after among collectors, enthusiasts, and even the general population?

The Top 10 Most Popular Luxury Brands of 2024 (So Far)

From timeless classics to contemporary chic, luxury brands have an undeniable allure.

Investing in Vintage Luxury Pieces: A Smart Move?

This article will dive into the various aspects of investing in vintage luxury pieces, discussing their allure, their investment value, the potential risks, and the considerations one should have in mind before making such an investment.

Flexible Terms. Secured Loans. White Glove Service.

Learn more about your favorite luxury brands

The Allure of Miu Miu: How the Brand’s Identity Redefines Feminine Fashion

Under the creative helm of Miuccia Prada, Miu Miu has established itself as a beacon of modern style, redefining what it means to dress femininely in the 21st century.

The Future of Luxury Assets: Predictions and Trends

As the market continues to evolve, a number of key trends and predictions have emerged that are poised to shape the future landscape of luxury assets.

Exploring Different Types of Luxury Assets: From Fine Art to Classic Cars

Ranging from fine art to classic cars, these luxurious items provide a unique investment opportunity.

From the Runway to Your Scent Collection: Exploring Hermes’ Exquisite Fragrances

In this article, we dive into the fascinating journey of how Hermes takes inspiration from the runway and translates it into their exceptional scent collection.

Unveiling the Not-So-Hidden Gems: Luxury Jewelry Brands Worth Knowing

Let’s delve deeper to shine a spotlight on some of the not-so-hidden gems in the industry.

The Basics of Palladium: A Comprehensive Guide to its Properties and Uses

Palladium is a rare and valuable metal that belongs to the platinum group of elements.

The Height of a Household Name: Ford’s Most Luxurious Rides for Discerning Drivers

In this article, we’ll explore Ford’s most extravagant and opulent vehicles that have become synonymous with luxury and prestige.

What are the Best Rolex Submariner Watches

Known for its exceptional craftsmanship and timeless design, the Submariner has become a symbol of prestige and style.

Miu Miu: A Closer Look at the Brand’s Signature Quirkiness

This article takes a closer look at the brand’s signature quirkiness, exploring its origins, unique style, influence on the fashion industry, celebrity endorsements, and its expansion beyond fashion.